LIBOR Risk Q2 2021

As the deadline to Libor cessation approaches, Liang Wu, executive director of financial engineering and head of cross asset product management at Numerix, presents a series of market themes that warrant closer inspection.

Modelling Energy Curves for XVA

Watch Numerix’s SVP of Quantitative Research Andrew McClelland present updates to his latest research, "Modelling Energy Curves for XVA."

The New Rules of Market Risk Management

This paper highlights several of the key viewpoints expressed by the panel and explores some the current dynamics that are impacting approaches to and the complexities of market risk management.

Next generation technologies and the future of trading

In this webinar, Numerix and Risk.net panelists examine the future of trading technology, how companies will implement these new innovations, and explore the range of new skills that might be needed.

The Art of Effective Market Risk Management During a Period of Transformation

White paper | The Art of Effective Market Risk Management During a Period of Transformation

SRP Europe Conference 2021: Optimizing Financial Valuations to Improve Investor Experience

During SRP’s 18th annual flagship conference, SRP Europe 2021, thought leaders from across the European market came together to examine, discuss and debate the state of Europe’s structured products industry.

QuantMinds 2020: Modelling Energy Curves for XVA

This on-demand webinar offers insights and commentary across several areas including: Seasonality in volatilities & correlations for energy curves; oil, gas, power, etc. | XVA & the importance of correlations | The Andersen ('10) model, akin to Cheyette ('92) with seasonality in response functions | Estimation via state-space representation and filtering | akin to Dynamic Nelson-Siegel (’06) | Objective measure-vs.-pricing measure implications and handling stochastic volatility.

Examining What's Next for LIBOR: Top Themes Dominating the Transition in 2021

In this new whitepaper, Numerix LIBOR transition expert Liang Wu provides his views and insights on the key themes that deserve examination.

Risk.net | Modifying Market Risk Management – A Year After Covid-19

Join this panel discussion with Numerix and Risk.net to understand how capital markets participants revised their market risk management practices during the height of market volatility and what this means for the future.

Don’t miss out on our latest insights and events sign up for our newsletter.

Adopting a Cloud-Based Risk Management Strategy

In this webinar, held in partnership with Microsoft, you will learn more about the value running real-time pricing and risk management calculations in the cloud can create for financial services firms

Real-Time Risk Management at the Enterprise Level: Uses and Benefits for Risk Managers

In this webinar hosted by CubeLogic, in partnership with Numerix, IOWArocks and PRMIA, market experts come together to examine the role real-time enterprise risk measurement and reporting has to play in practice today.

Quantitative R&D Innovations Update

In this new research quantitative experts overcome this significant limitation and develop a new type of neural networks that incorporate large-value asymptotics, when known, allowing explicit control over extrapolation.

Neural Networks with Asymptotics Control

In this webinar you will learn more about some of the advantages and use cases for applying machine learning, deep learning, and neural networks in mathematical finance.

Risk Magazine Cutting Edge Article | Machine Learning: Deep Asymptotics

In this research, Drs. Alexandre Antonov, Michael Konikov and Vladimir Piterbarg overcome limitations and develop a new type of neural network that incorporates large-value asymptotics, allowing explicit control over extrapolation.

Risk Magazine Cutting Edge Article | Multi-curve Cheyette-style models with lower bounds on tenor basis spreads

This article presents a general multi-curve Cheyette-style model that allows precise control over tenor basis spreads.

Risk.net | LIBOR Telethon: Derivatives, Trading and Liquidity

In December, Risk.net hosted a LIBOR Telethon where they sourced dozens of pressing questions from the Risk.net audience and hosted a live Q&A session with a panel of industry experts.

The Impact of New Alternative Reference Rates on Curve Instruments and Curve Modelling

In November 2020 Numerix had the privilege of participating in Asia Risk Congress, Asia's leading risk management, derivatives and regulation event. At that event, Thomas Chan, Director, Financial Engineering for Numerix based in Hong Kong presented on-camera an in-depth presentation exploring the LIBOR Transition. With LIBOR cessation on track for a December 2021 end, the goal of this presentation is to bring the Asian markets up to speed on transition progress.

Adapting Market Risk Management Practices Amidst COVID-19

Learn what questions banking and capital markets risk managers should be asking themselves right now in terms of stress testing, scenario analysis and market risk practices in the wake of COVID.

Numerix Journal Vol. 4 No. 1

*SPECIAL ISSUE- FRTB * The Vol. 4 No. 1 issue focuses on FRTB (the Fundamental Review of the Trading Book). In this issue, we include four Fundamental Review of the Trading Book papers, each exploring a different aspect of FRTB. The papers selected break down the underlying regulatory requirements, explain the implementation challenges, analyze the differences between IMA and SA, and look at the credit valuation adjustment (CVA) and initial margin frameworks.

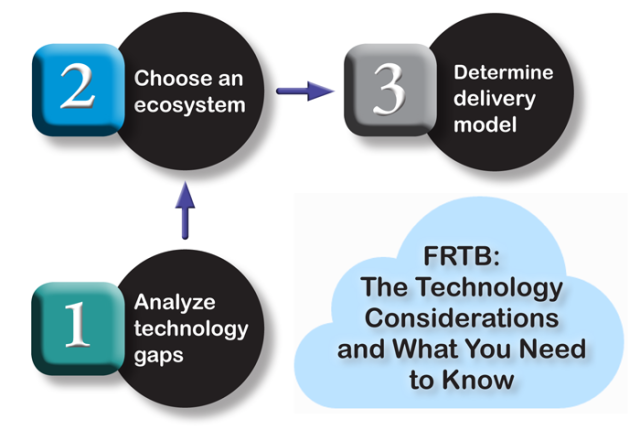

FRTB: The Technology Considerations and What You Need to Know

FRTB will manifestly change the way banks run their trading business; banking infrastructure must rise to new demands. With band-aided, legacy systems becoming costly to adapt and falling short, this paper helps banks to better understand the technology architecture needed to meet the new flexibility, agility, scalability and computational requirements.

The Fundamental Review of the Trading Book: Key Challenges and Implementation Headaches

Franck Rossi, Director of Product Management at Numerix, discusses the challenges presented by FRTB - from increasing capital requirements to P&L Attribution to IT review. In this paper, he explores what banks can do to adequately prepare.

PV and XVA Greeks for Callable Exotics by Algorithmic Differentiation

We generalize the algorithmic differentiation method proposed by Antonov (2016) from price Greeks to XVA Greeks.

Numerix Journal Vol. 3 No. 2

*SPECIAL ISSUE- CURVES & CURVE CONSTRUCTION * In the Vol 3 No 2 special edition of the Numerix Journal, we present three papers on curve-related topics, including multi-curve methods. We conclude with an article introducing Numerix multi-curve functionality, both current and planned.

FRTB's Sensitivity Based Approach: Methodology, Procedure and Business Impact

Franck Rossi, Director of Product Management at Numerix, discusses the challenges presented by FRTB - from increasing capital requirements to P&L Attribution to IT review. In this paper, he explores what banks can do to adequately prepare.

Algorithmic Differentiation for Callable Exotics

Dr. Alexandre Antonov studies the algorithmic calculation of present values greeks for callable exotic instruments.

Numerix Journal Vol. 3 No. 1

Vol 3 No 1 Issue of the Numerix Journal explores the economic rationale and numerical methods used to address the KVA problem, techniques used by Numerix to calibrate a number of FX and interest rate models under the real-world measure, the Hedge Performance Test as a method of evaluating regulatory “fitness for purpose” of a model, and offers an introduction to Numerix Model Validation Services and Model Validation Studio.

Understanding the Riskiness of A GLWB Rider For FIAs

Credit support annexes specify rules for posting collateral. In this paper, Drs. Alexander Antonov and Vladimir Piterbarg propose advanced approaches for valuing the optionality of currency choice in multi-currency CSAs.

Don’t miss out on our latest insights and events sign up for our newsletter.

‘Finalized,’ but Far from the Finish Line – Preparing for the Next Evolution of FRTB

While the final FRTB text has some important changes from the fourth QIS of July 2015, including an extra year for implementation (with a new deadline of January 1st, 2019 for local translation and Dec 31st for latest date for 1st report submission by the financial institutions) and a reduced Residual Risk Add-on—many of the key rules in the framework remain unchanged from prior versions. Derivate market participants are finding the scope and complexity of the framework quite daunting.

Regulatory Guide to Understanding Bank Capital and Margin Requirements

Extensions and revisions of bank capital and margin requirements have given rise to increased interest in capital calculations and the methods employed. Our blog showcases insights on this topic from Dr. Serguei Issakov, Global Head of Quantitative Research at Numerix.

Numerix Celebrates 20 Years of Innovation in Pricing and Risk

In this blog, we discuss our experience at Numerix as a company embarking on our 20th year in business. We are proud of both the legacy behind us and the exciting future before us.

Numerix Journal Vol. 2, No. 2

In light of the continuously increasing demand for more efficient and sophisticated risk solutions, Vol 2 No 2 of the Numerix Journal is a Special Edition dedicated to risk. The issue showcases the most recent research and developments in risk at Numerix, much of which pertains to real-world modeling

Risk Magazine Cutting Edge Research Article | Funding Valuation Adjustment for General Instruments

In this Cutting Edge research article, published in the November 2015 Issue of Risk Magazine, Drs. Alexandre Antonov, Marco Bianchetti and Ion Mihai develop a universal and efficient approach to numerical FVA calculation.

"Hot-start" Initialization of the Heston Model

The most straightforward way of initializing a hidden variable is by specifying its equilibrium distribution, which assumes that this component of the multifactor process has been started well before the observable part. As a practical example, the Heston model is considered.

Risk Magazine Cutting Edge Research Article | The Free Boundary SABR: Natural Extension to Negative Rates

In this Cutting Edge article published in the September 2015 Issue of Risk Magazine, Alexandre Antonov, Michael Konikov, and Michael Spector have presented a natural generalization of the SABR model to negative rates.

Research In Brief | Negative Rates: The Challenge and the Opportunity

Dr. Ion Mihai, explores how negative interest rates have recently become a critically important issue in finance.

Bringing Real-time Risk into the Decision-making Process

Satyam Kancharla discusses how and why using integrated analysis tools with drill down and real-time capabilities is essential for effective decision-making.