PolyPaths Trading & Risk Management

Advanced risk and analytical capabilities for fixed income and structured finance portfolio management

Make informed decisions, optimize structured finance portfolios, and achieve superior investment outcomes

PolyPaths Trading & Risk Management is a versatile, user-friendly fixed income and structured finance portfolio management platform engineered to revolutionize fixed income portfolio construction and risk management. It caters to the dynamic needs of financial professionals by offering advanced analytical capabilities and a comprehensive set of tools for pre-trade analysis, portfolio risk measurement, asset liability management, hedge analysis, and Value at Risk (VaR). Equipped with advanced risk and portfolio management capabilities across a broad spectrum of fixed-income and structured finance instruments and versatile deployment options, it integrates seamlessly into your existing infrastructure. The suite’s speed and scalability, coupled with its intuitive user interface, make it an indispensable tool for traders, hedge fund managers, portfolio managers, risk managers, research analysts, and asset liability managers.

Capabilities

Advanced analytical capabilities

Designed with the evolving needs of financial professionals in mind, the suite offers advanced analytical capabilities that streamline fixed income and structured finance portfolio management. It boasts a comprehensive set of tools for pre-trade analysis, portfolio risk measurement, asset liability management, hedge analysis, and Value at Risk (VaR), providing a seamless and efficient management experience.

Streamlined fixed income and structured finance management

Extensive coverage of all fixed-income and structured finance instruments, such as bonds, structured notes, mortgages, loans, asset-backed structured products, deposits, and derivatives. In addition, users can load and value mortgage servicing rights and whole loan portfolios.

Robust portfolio risk measurement

Equipped with robust tools for portfolio risk measurement, the suite empowers clients to effectively understand and manage the risks associated with their portfolios. This includes a comprehensive range of measures such as static risk measures, option-adjusted measures, partial durations, along with capabilities for stress testing and scenario analysis, and more

Benefits

-

Ease of use and integration

PolyPaths’ user-friendly interface streamlines portfolio construction, pricing assumption entry, and report viewing. Its batch utility further simplifies the process by automating routine risk reporting jobs and maintenance tasks. PolyPath also integrates easily with user-supplied models and data, and its outputs can be exported to other systems, ensuring a seamless user experience adaptable to the client's needs

-

Speed and scalability

PolyPaths’ Distributed Processing system, with its robust parallel architecture, efficiently manages large-scale calculations and supports thousands of processors. Its web-based console offers continuous grid status monitoring, enhancing scalability and efficiency while significantly cutting costs.

-

Versatile deployment

Unlike many other solutions, PolyPaths Trading & Risk Management offers both on-premise and client-managed cloud instance options, providing flexibility based on the organization’s needs

-

Broad user applications

Whether actively trading or analyzing pre- or post-trade data, the system boosts efficiency, performance and investment results for multiple users across the financial institution including traders, hedge fund managers, portfolio managers, risk managers and research analysts.

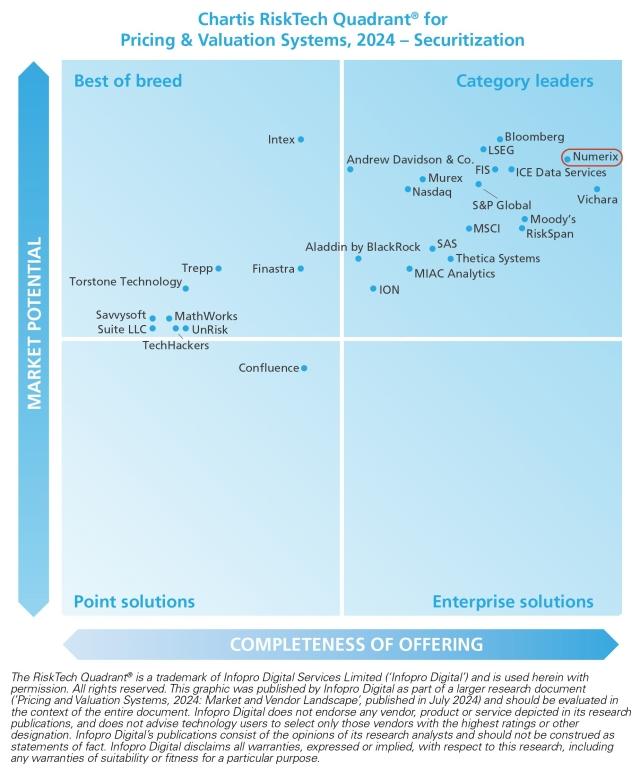

Numerix named a leader

In the 2024 Chartis Research RiskTech Quadrant® for Pricing and Valuation Systems, 2024 – Securitization

Capital markets awards that speak for themselves

Product factsheet

PolyPath’s Trading & Risk Management

Discover how PolyPaths Trading & Risk Management can revolutionize your fixed income and structured finance portfolio management.

Want to see Numerix PolyPaths Trading & Risk Management in action?